That’s how long I’ve been entangled in this web that I call The Petch House.

I finished the laundry room, and yesterday I was sort cleaning up all of the tools, while at the same time getting everything out of the remaining half of the butler’s pantry. The butler’s pantry will be the next project. This room had become another one of those collection spots in the house for small things that I’m not sure what to do with.

One of the largest items in the room was the mini fridge I used while I was remodeling the kitchen a few years back. I listed it on Craig’s List (Sold the same day!) and I wanted to get it cleaned up. I pulled it away from the wall and behind it was a copy of the original pest inspection report from when I bought the house 6 years ago.

The report is dated April 1st, 2002, and I remember we had a 30 day escrow because we – the owner and I – were both eager to finish the deal quickly. I don’t remember exactly when escrow closed, but it was towards the end of May, so that makes it 6 years in the next week or two.

The inspection report is not pretty, and I don’t mean because it was behind a fridge for a few years. It goes on for 10 pages (legal size) listing all of the problems with the house. The inspection report only deals with problems of structural, rot, fungus, and infestation. It covers both the house and the 2 apartments over the garage. Fifty seven hundred square feet of living space! If you throw in the garages and walk-up attic it is 8550 sq. ft. of floor space. I read it again yesterday and all I could think was, “What the hell was I thinking when I bought this place”.

To give you some idea of just how bad it was, when we were in escrow the first appraisal was called off by my mortgage broker because the appraiser called her half way through and went on and on about how bad the place was. She called me and told me it wasn’t going well and asked me if I wanted to continue. I told her to give me two weeks. While we were in escrow I went over every day and cleaned up the apartments over the garage so they would at least look rentable. I spent about a $1000 on paint, door replacement, and window repair, and made several dump runs before I even owned the place. The second appraisal went a little better.

The big-ticket items on the pest inspection were the three porches and the two story addition. On the report he suggested replacing all of the porches with Trex Decking and pressure treated wood. Right, on an 1895 Victorian. {roll eyes} I rebuilt 2 of the porches with redwood and fir. The rest of the report lists lots of little things. It is the inspectors job to point out every little problem and he did.

There are also notes of interest on the report. These are things that may fall outside the scope of the inspection, but he felt obligated to mention them. Things like the numerous broken windows, plumbing leaks, piles of debris and garbage in the back yard, peeling vinyl floors and ratty carpets. It was also noted that he was unable to inspect under the house because of the large amount of “broken glass and garbage”. Other areas were inaccessible because of sagging plumbing and unsafe wiring. Again, what the hell was I thinking when I read all of that 6 years ago. I’m not sure, really, but what can I say, love is blind.

On the last page the inspector tallies up the dollar amounts to fix all of the things on the report. This has nothing to do with addressing code issues. Nor does it address any electrical or plumbing problems. No HVAC. Nothing cosmetic in anyway. This has nothing to do with an Occupancy Permit, because they aren’t required here. This is just to repair structural issues that could lead to the house going from really bad to “It needs to be bulldozed”. This is for the bank, basically. The grand total was $20,030.00 + T&M.

I guess the “+T&M” means “Plus Time and Materials”. I never really asked about this at the time, but after reading it now, I would think the $20,030.00 would have included some time and materials. Maybe that is just away to cover his butt because the inspector knows it will most likely go higher. I’m sure at the time, rather than seeing the report as a red flag, I saw it as a bargaining tool when making an offer on the house.

Actually, I used the report more like blunt instrument than a tool. I doubled the value at the bottom of the report and added $10,000 more, subtracted that from the asking price, and that was my offer. I would take the house as-is and the current owner could walk away. Although it wasn’t stated in writing, through my realtor it was intimated that this was not a starting point for negotiations. This was my one and only offer and they had 24 hours to respond. I like playing hardball, and we all know what the answer was.

I was putting a very large down-payment on the house so I could ignore the report. If it worked out the way I planned I would instantly have more than 50% equity in the house. Big woop, right, on a house that is in such bad shape? Really, what this meant was that even if the place did crumble in to the ground, the bank could recoup their stake in the house just on the value of the land. Maybe they don’t actually look at it in those terms, but that is essentially what it meant. My stellar credit rating helped, I’m sure.

It was a good risk for the bank and a bad risk for me. I took every last cent I had ever saved in my life and dumped it in to a house that seemed to need more work than I could ever do myself and could never afford to pay to have done. I don’t remember exactly, but at the close of escrow I had something like $300 to my name. This could have ended up being very, very bad. And since its not over yet, I guess it still could.

Below is the short list of what I’ve done in the last 6 years. All work needing it, is done with permits, inspected, and meets code.

- Remodeled 2 apartments over the garage, and I have great tenants

- Removed 3 bathrooms and 3 kitchens (rentals)

- Removed 2 story addition

- Rebuilt 2 porches

- All new wiring from the poll on, with new sub-panels and main disconnect

- All new copper water lines from the curb on and several new drains

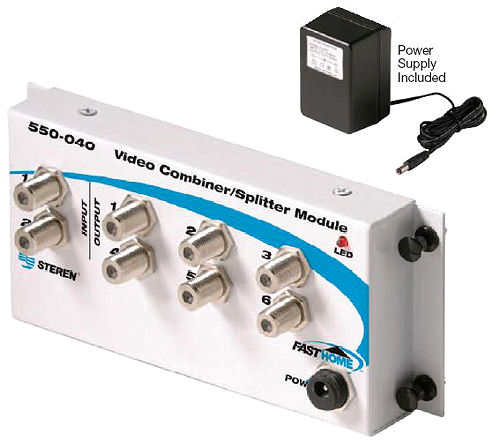

- All new phone lines, CATV, and coaxial from the poles on (work in progress)

- Restored kitchen and bathrooms, including building my own cabinets

- Stripped off asbestos siding and restored exterior detail

- Had all of the missing interior and exterior trim remilled out of salvaged old-growth redwood.

- Stripped exterior to bare wood and repainted

- Built a laundry room

- Stripped all of the wallpaper and old flooring back to bare plaster and original floors

- Stripped all of the paint out of 4 rooms – all with LOTS of woodwork

- Removed all of the 1920s partitions and rebuilt walls

- Cleaned a “shooting gallery” out of the attic

- Purchased antique lighting for the entire house (mostly rewired and installed)

- Purchased antique tile for the 2 fireplace hearths

- Purchased antique doorknobs, mortise locks, and hinges for all of the doors

- Purchased antique Eastlake doors for the entire house

- Plus 1.4 zillion other little things

The last 6 years have been a blur, but really a lot of fun. To date my total debt is $9,000 on a $20,000 home equity line of credit. Four thousand of the $9,000 debt went for dental work and taxes 2 years ago. My 2 credit cards carry a zero balance. There are a lot of things about my life that I’m not proud of, but boy, this is not one of those.

There are still 1.2 zillion little things left to do and there are some big jobs left, as well. I need to rebuild 2 chimneys. I need to replace all of the sidewalk around the house and build fences. I need to insulate the attic and put in some type of heating system. And the next thing I’m doing – the one that makes me the most nervous – is to rebuild the missing cabinets in the dining room. After that, the rest is financially minor, cosmetic stuff.

Stay tuned, the next six years are to be a nail-biter.